US-amerikanerna som betalar så låga skatter, hela mellanskillnaden mellan vad de betalar i skatt och vad svenskarna betalar i skatt, den måste de väl kunna lägga på fritt vald konsumtion av roliga saker som pizza och Bud Light?

US-amerikanerna som betalar så låga skatter, hela mellanskillnaden mellan vad de betalar i skatt och vad svenskarna betalar i skatt, den måste de väl kunna lägga på fritt vald konsumtion av roliga saker som pizza och Bud Light?Inte riktigt.

Tuition fees som % av medianhushållets disponibla inkomst för ett svenskt hushåll: 0,0%.

Hal Weitzman, "Debt fears drive US youth away from college", FT 14 juli 2011

---

Uppdatering 4 augusti

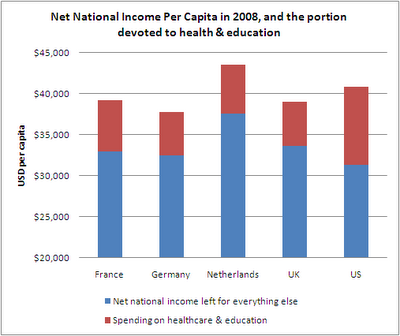

Foljande diagram fran fina Street Light blog visar pa ett bra satt den mer generella poangen som jag ville gora:

Kash Mansori, "National Income Comparisons Between Europe and the US", street light blog 12 maj

---

Uppdatering 12 december 2011

Bra illustrationer till detta ges av Edward Luce fina reportage om den US-amerikanska medelklassens kris från Financial Times förra året. Luce besöker familjer i Minneapolis och en förort till Washington D.C för att hitta illustrationer av den "squeeze" på vad US-amerikanerna kallar medelklassen, vad vi i Sverige kanske skulle kalla de breda löntagarskikten eller "svenssons", som de senaste trettio årens ökade inkomstojämlikhet innebär.

"technically speaking, Shareen is relatively comfortable. Because her husband works for a fire safety company and brings in $70,000 a year, the Millers are clearly surviving. But they dread what would happen if either had a medical crisis. A few years ago Shareen had a tumour removed from her diaphragm, which left her $17,000 in debt. And her husband suffers from a herniated disk. Remarkably, given that their gross joint income is double the US median, Shareen has had to postpone a dental operation for six months in order to pay off her car loan. Nor does she have time to upgrade her skills. 'One thing about people who work with the disabled is that they never have any spare time,' she says. /.../

Shareen’s son and daughter-in-law, Dustin and Ruth, both aged 23, recently had to move back home because they could not afford to rent, even though both hold down jobs – Dustin with a bath remodelling company, Ruth in a fabrics store. Both did well in high school and would like to study marine biology – a skill of the future. But they cannot afford the debt.

While incomes in America are stagnating, the cost of education is soaring. Since 1990, the proportion of Americans who are paying off more than $20,000 in student loans a decade after they graduated has almost doubled. Lawrence Summers, Obama’s chief economic adviser, who has long worried about the growth of what he calls America’s 'anxious middle', points out that of the major economies, the US has the highest share of graduates in the workforce. But if you take the 25-34-year-old age group, America is not even in the top 10. "

Luce, "The crisis of middle-class America", 30 juli 2010

Inga kommentarer:

Skicka en kommentar